Donate

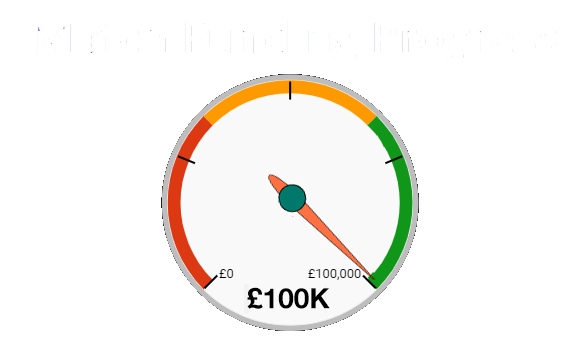

We have successfully reached our goal of raising £100,000 in matched funding. This is an extraordinary achievement which enables us to complete the restoration of Meads Hall. The MECC Trustees would like to thank all of you who donated and made this happen.

We are still fundraising though as we would like to install fittings and features including a fully kitted out kitchen, stage curtains and a new sound and video system. If you can, please donate so we can make the hall an even more attractive events venue. Remember that any donations above £1,000 will be noted on our sponsorship board.

We are now fundraising

We did it!

Total of all donations, grants and money raised at fundraising events

Donations

Please see the GiftAid section below to boost your donation.

Donate by cheque:

Payable to: Meads (Eastbourne) Community Centre

Please include your contact details and a GiftAid declaration (see below) if appropriate, and send to:

48 Park Gates

Chiswick Place

Eastbourne

BN21 4BE

Donate by bank transfer:

Name: Meads (Eastbourne) Community Centre

Sort code: 23-05-80

Account no.: 56961186

Ref.: surname+postcode+house number

(e.g. anyoneBN217GH7)

Donate online:

You can also donate online using the form below.

Gift Aid

Boost your donation by 25p of Gift Aid for every £1 you donate.

If you are a UK taxpayer, we can claim Gift Aid worth 25p for every £1 of your donation, so long as you complete and return a simple declaration.

You can opt to Gift Aid a one-off donation, or to Gift Aid every time you donate (even past donations made within four years).

Donate online below or by post by downloading a form here

Donations and/or Gift Aid form

Cancellation / Change of Details

Please notify Meads (Eastbourne) Community Centre if you want to cancel your Gift Aid declaration or change your name or home address by email to treasurer@meadshall.org.

Higher or Additional Rate Taxpayers

If you pay Income Tax at the higher or additional rate and want to receive the additional tax relief due to you, you must include all your Gift Aid donations on your Self-Assessment tax return or ask HM Revenue and Customs to adjust your tax code.

Sponsorship board

All donations above £1,000 will be noted on the Hall’s sponsorship board.